Introduction

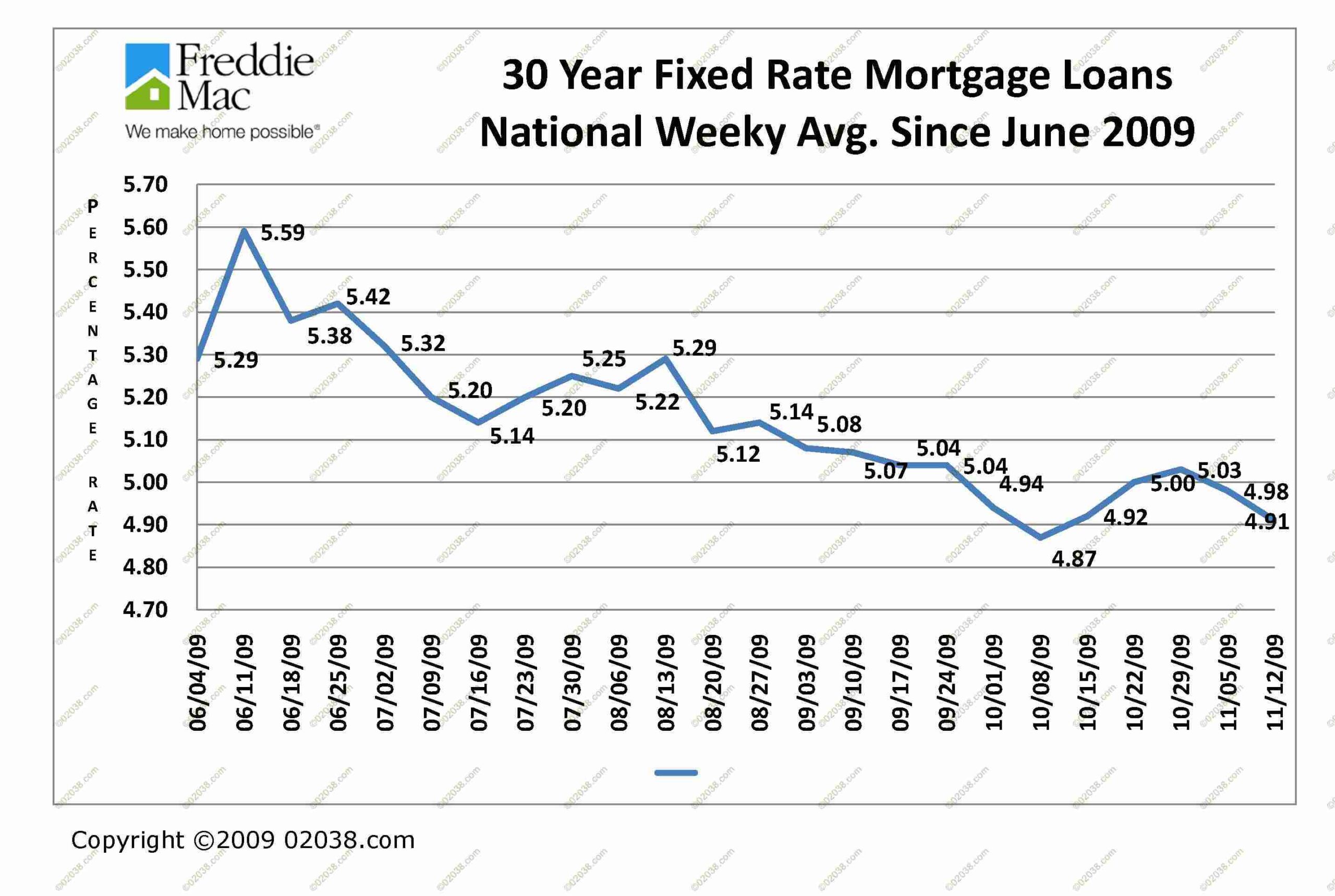

Mortgage rates today play a critical role in the real estate market, affecting prospective homebuyers and current homeowners looking to refinance their existing loans. As of October 2023, rates have seen fluctuations due to various economic factors, which make it essential for individuals to stay updated on the latest trends and forecasts.

Main Body

According to data from the Bank of England, the average mortgage rate for a two-year fixed-rate mortgage currently stands at 6.24%, while five-year fixed-rate options have averaged around 5.95%. These rates have increased compared to figures from earlier this year, reflecting the ongoing impact of rising inflation and economic uncertainty.

Various factors contribute to these shifts in mortgage rates, including the Bank of England’s monetary policy aimed at curbing inflation, which has resulted in consecutive interest rate hikes over the past year. Homebuyers are encouraged to lock in their rates quickly, as experts predict that mortgage rates may continue to rise into late 2023, driven by further adjustments in the economic landscape.

In addition to national trends, regional differences in mortgage rates can be observed. For instance, urban areas may experience slightly higher rates compared to rural regions due to varying demand levels and property prices. First-time buyers often find it more challenging to enter the market in a high-rate environment, leading to increased reliance on government assistance schemes and available support.

Conclusion

Mortgage rates today are a crucial consideration for anyone looking to buy property or refinance an existing loan. The current upward trend indicates that potential buyers should act swiftly to secure favourable terms. As the economic climate continues to evolve, monitoring these rates will be vital for financial planning and decision making. Homebuyers should consult with financial advisors and mortgage brokers to explore their options and make informed choices in this fluctuating market.