Introduction

In recent years, fintech innovation has become a buzzword in the financial industry, signifying a wave of change driven by technology. This transformation is relevant as it fundamentally alters how individuals and businesses manage their finances, from payments and loans to investments and insurance. As we navigate through a post-pandemic world, understanding the implications of these innovations is essential for consumers and financial institutions alike.

Major Developments in Fintech

Several trends have emerged in the fintech landscape that underscore its importance. For example, digital banking platforms have surged in popularity, allowing users to manage accounts entirely online without the need for physical branches. According to a recent report by Finastra, digital banking adoption has risen by more than 30% since the onset of COVID-19, with many users preferring to conduct transactions via mobile apps.

Additionally, the rise of payment solutions like mobile wallets (e.g., Apple Pay, Google Pay) and buy-now-pay-later services (e.g., Klarna, Afterpay) has altered consumer purchasing behaviour. A study from McKinsey indicates that these services can improve cash flow management for both consumers and businesses, making them appealing in today’s economic climate.

Technological Integration

Fintech innovation is not solely about convenience; it often incorporates advanced technologies to enhance security and efficiency. For instance, blockchain technology has gained traction, providing transparent and secure transaction methods that can significantly reduce fraud. Similarly, artificial intelligence (AI) is being employed for risk assessment and to improve customer service through chatbots and personalised financial advice.

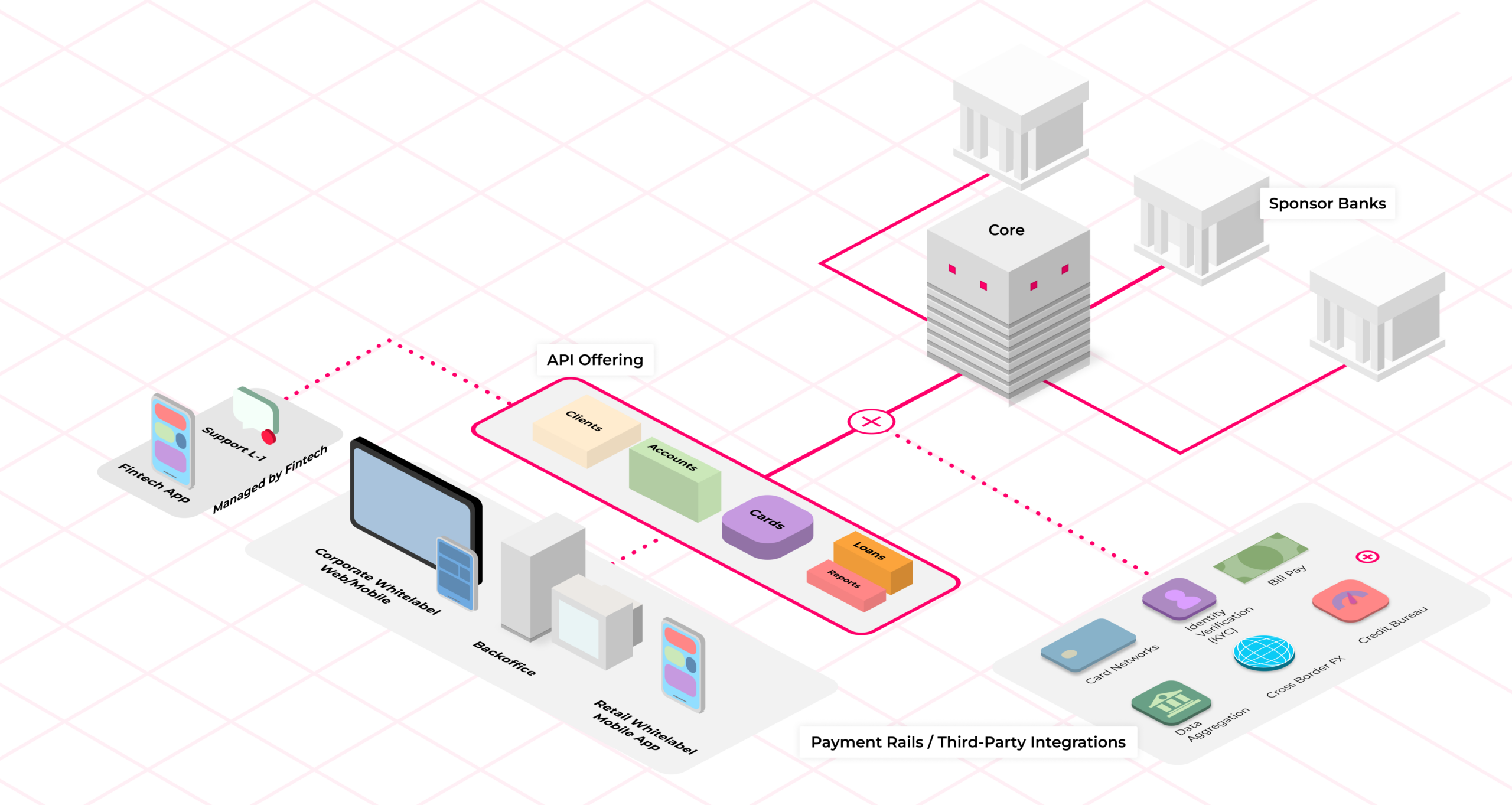

Another significant aspect is the concept of open banking, mandated by regulations in various regions, which allows third-party developers to build applications and services around financial institutions. This fosters competition and drives innovation, making financial services more accessible and tailored to customer needs.

The Future of Fintech

Looking ahead, the fintech landscape is set for continued evolution. As digital currencies and central bank digital currencies (CBDCs) come into play, traditional finance could face substantial disruption. Analysts predict that by 2025, the fintech sector will account for more than 20% of the global banking market share, cementing its role as a critical component of the financial ecosystem.

Moreover, as technology advances, we can also expect improvements in regulatory frameworks to ensure consumer protection while fostering innovation. The interplay between technology and regulation will be essential for sustaining growth and addressing challenges such as cybersecurity threats and data privacy concerns.

Conclusion

In conclusion, fintech innovation is reshaping the financial landscape, ushering in a new era of accessibility, efficiency, and security. For consumers and businesses, understanding these changes is crucial for making informed financial decisions. As the fintech sector continues to grow and evolve, staying updated will be vital for harnessing the full potential of these innovations.