Introduction

Money is a fundamental component of modern economies, serving not only as a medium of exchange but also as a unit of account and a store of value. Its significance extends beyond simple transactions; it influences social structures, economic stability, and individual lives. Understanding the role of money, particularly in the context of today’s shifting financial landscape, is crucial for individuals navigating their personal finances.

The Evolution of Money

Historically, money has evolved from barter systems, where goods and services were exchanged directly, to the use of physical currencies, and now to digital transactions. The rise of cryptocurrencies and online banking platforms signifies a dramatic shift in how money is perceived and utilized. In recent years, digital currencies such as Bitcoin have prompted debates about the future of traditional financial systems, illustrating the need for continuous adaptation to advancements in technology.

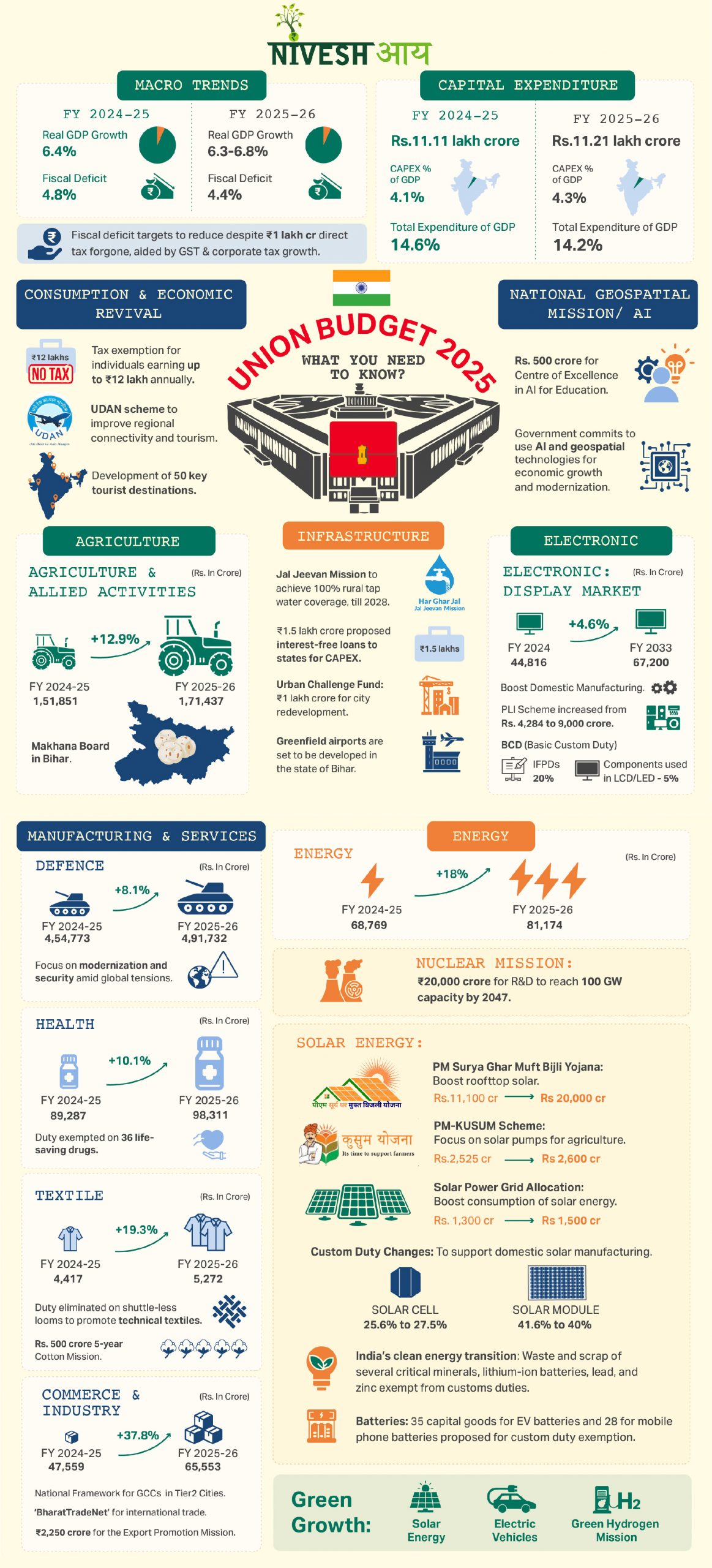

The Role of Money in the Economy

Money functions as a lubricant for the economy, facilitating trade and commerce. Central banks, such as the Bank of England, manage national monetary policies to control inflation, influence interest rates, and stabilise the currency. Effective money management can lead to economic growth, while mismanagement can precipitate crises, as evidenced by the financial crises in 2008 and the current challenges faced by economies around the world post-pandemic.

Personal Finance and Money Management

On a personal level, understanding money management is essential for achieving financial stability and growth. With rising costs of living and fluctuating incomes, individuals are increasingly seeking strategies for budgeting, saving, and investing wisely. The importance of financial literacy cannot be overstated; it empowers individuals to make informed decisions, minimises debt, and maximises returns on investments.

Conclusion

The conversation surrounding money is more relevant than ever, as the economy continues to evolve and new financial challenges emerge. For readers, understanding the role of money in both the macroeconomic and personal finance contexts is fundamental for making sound financial choices. As digital trends continue to shape the landscape, staying informed and adaptable will be key to leveraging money effectively for personal and societal progress.