Introduction

Student loans are a crucial aspect of higher education financing in the United Kingdom, enabling students from various backgrounds to access university education. As tuition fees continue to rise, many students rely on these loans to finance their academic pursuits. Understanding the implications of student loans is vital for both current and prospective students, given the growing concerns over debt levels and the return on investment of higher education.

The Current Landscape of Student Loans

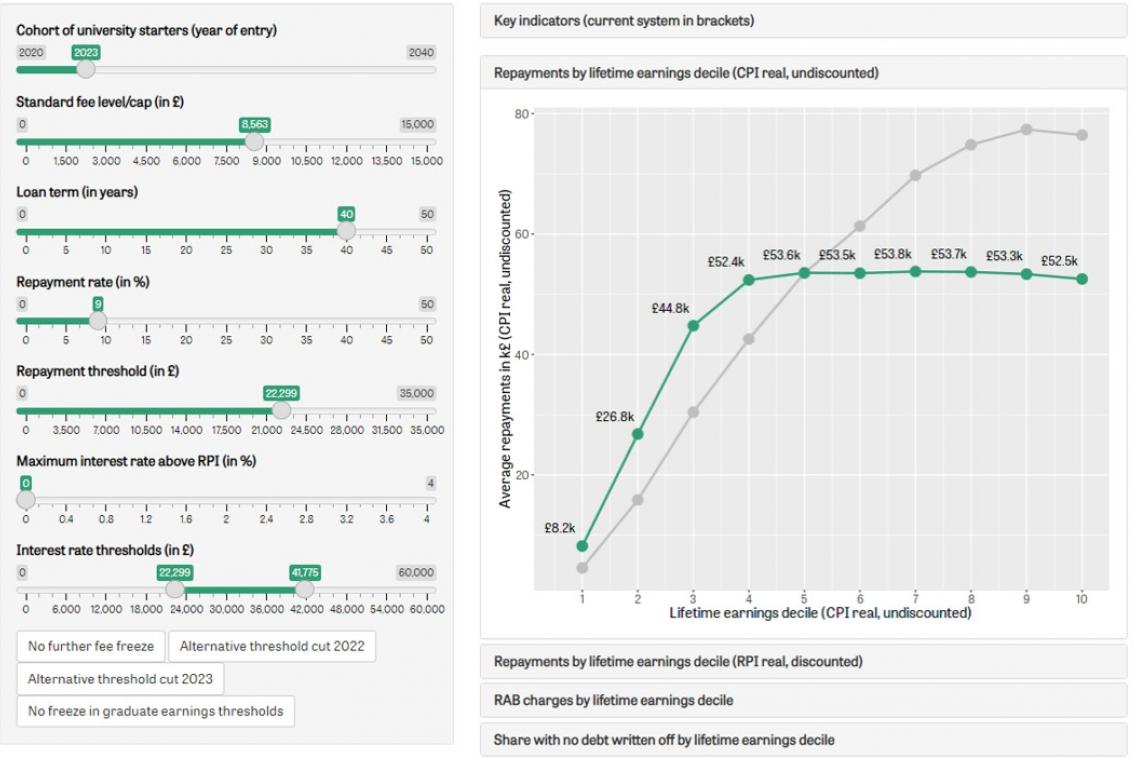

As of 2023, student loans in the UK can cover tuition fees of up to £9,250 per year for undergraduate courses. The government provides various repayment plans based on the income of graduates. However, recent reports indicate that rising living costs and stagnant wages are making it increasingly difficult for graduates to repay their loans effectively. According to the Institute for Fiscal Studies, approximately 40% of students are expected to never fully repay their loans. This statistic raises crucial concerns about the sustainability of the current student loan system.

Recent Developments

In recent months, there have been calls for reforms to the student loan system. The Student Loans Company announced in early 2023 that it would initiate a review of repayment plans to better align them with the current economic climate. Additionally, the government has been discussing potential changes to interest rates on loans, which has sparked considerable debate among educational stakeholders. For instance, students currently repay their loans with interest calculated at inflation rates, but some experts argue this may burden graduates more than anticipated.

Financial Literacy and Future Trends

With an increasing number of students entering higher education, financial literacy has become essential. Institutions are now emphasising education on managing student loans and debt, encouraging prospective students to understand the implications of borrowing. Universities are hosting workshops which outline practical steps to minimise debt, encouraging informed decision-making regarding course selections and financial planning.

Conclusion

In conclusion, as student loans continue to shape the higher education experience in the UK, both challenges and reforms are emerging. Understanding the intricacies of student loans will support students in making informed educational choices and managing future debt effectively. Looking ahead, it is crucial for policymakers to address these issues to ensure the system evolves in a way that balances accessibility with financial sustainability for future generations.