Introduction

The surge of cryptocurrency trading in recent years has transformed how individuals and institutions approach investing. As digital currencies gain popularity, understanding the dynamics of cryptocurrency trading has become increasingly important for investors worldwide. This year, the market has faced significant shifts, presenting both challenges and opportunities.

Current Trends in Cryptocurrency Trading

2023 has seen a remarkable increase in activity within the cryptocurrency market. Bitcoin, Ethereum, and other leading cryptocurrencies have maintained their positions, yet new entrants are also gaining traction. The total market capitalisation of cryptocurrencies reached approximately $2.2 trillion in March 2023, reflecting renewed interest after a period of volatility in 2022.

One of the most notable trends is the rise of decentralised finance (DeFi) platforms, which allow users to engage in trading without traditional intermediaries. DeFi has opened doors for innovative trading strategies, attracting a new demographic of traders seeking greater autonomy and potential returns.

Regulatory Developments

As cryptocurrency trading grows, so does the scrutiny from regulators worldwide. Several countries have begun implementing stricter regulations to ensure consumer protection and prevent fraudulent activities. The Financial Conduct Authority (FCA) in the UK has issued guidelines to regulate cryptocurrency promotions while ensuring that firms operating in this space comply with existing financial regulations.

Challenges in Cryptocurrency Trading

Despite its rapid growth, cryptocurrency trading carries inherent risks. Price volatility remains a significant concern, with substantial fluctuations in market values presenting challenges for traders. Moreover, the lack of widespread institutional adoption has led to liquidity issues in certain cryptocurrency markets, affecting transaction efficiency and costs.

Future Outlook

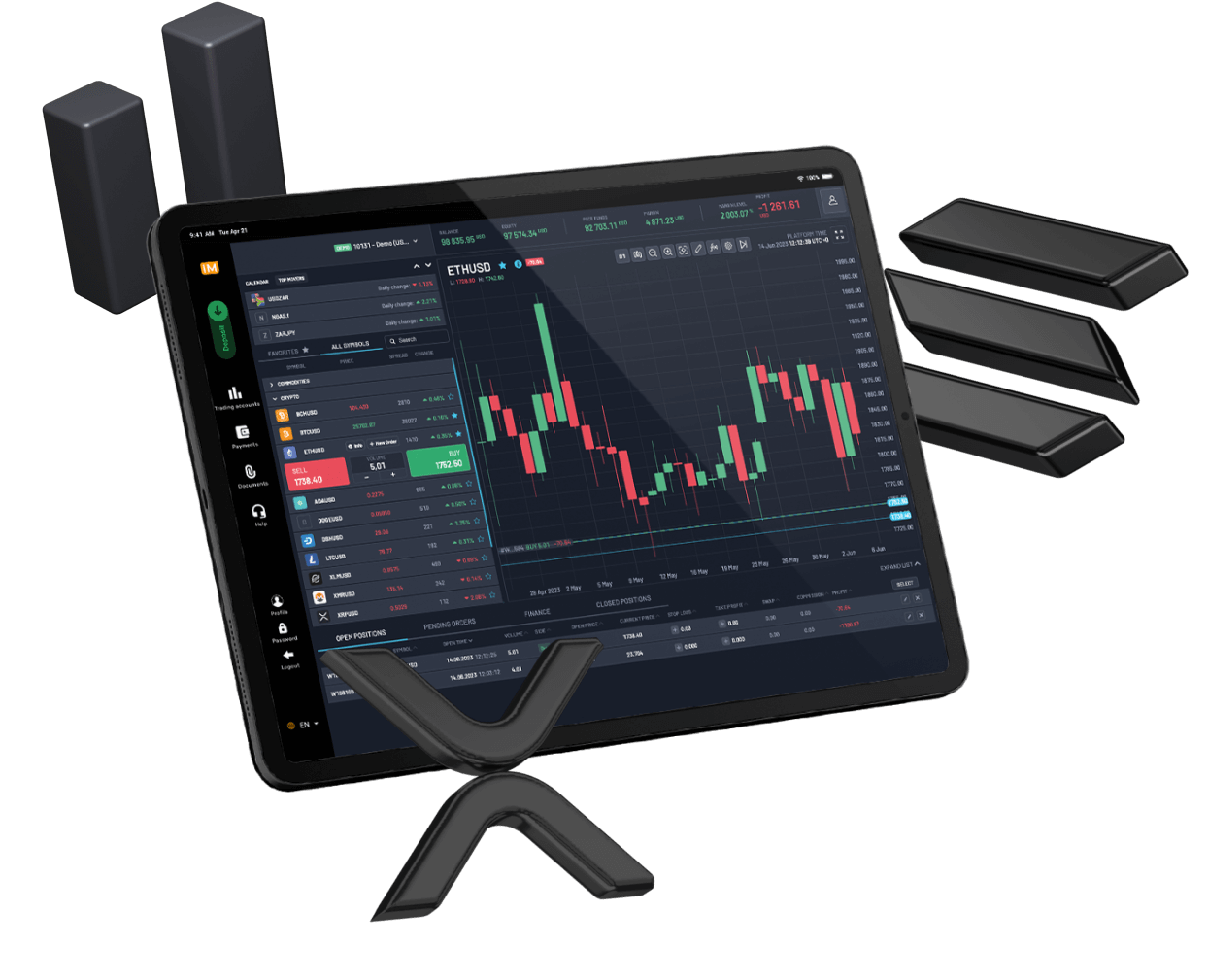

The future of cryptocurrency trading in 2023 and beyond appears promising yet uncertain. Analysts predict that as technological advancements continue to shape the landscape, there will be more efficient trading tools and platforms for investors. Additionally, the increasing adoption of blockchain technology across various sectors may enhance investor confidence and fuel market growth.

Conclusion

In conclusion, cryptocurrency trading in 2023 has emerged as a complex and evolving domain, marked by both opportunities and challenges. Investors need to stay informed about market trends and regulatory changes. As cryptocurrency continues to evolve, those who adapt and understand the market dynamics will likely find success in this burgeoning field.