Introduction

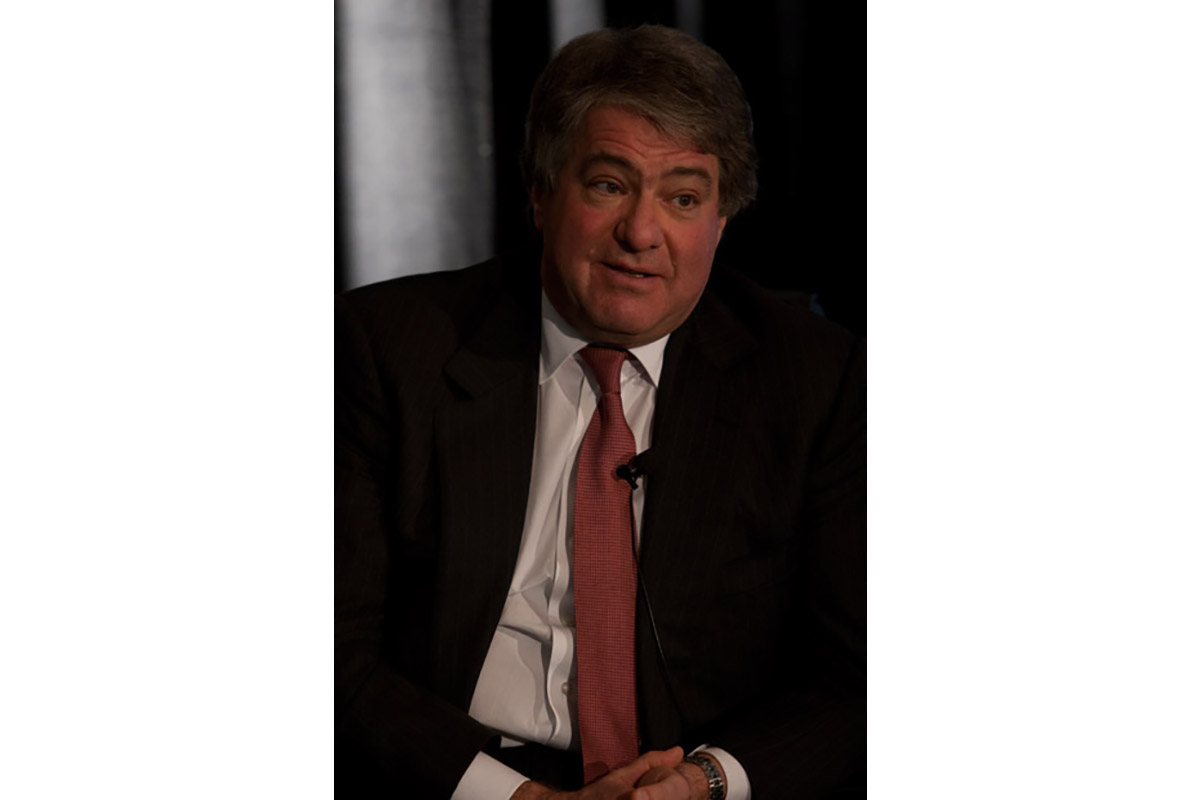

Leon Black, a prominent figure in the world of finance and a co-founder of Apollo Global Management, has been influential in shaping the private equity landscape. His experiences and decisions, particularly in recent years, have shed light on the complexities of wealth management and ethical considerations in finance. Understanding his journey is crucial, as it reflects broader trends in investing and corporate governance.

Career Journey

Leon Black co-founded Apollo Global Management in 1990, rapidly establishing it as one of the leading private equity firms. Under his leadership, Apollo has managed tens of billions in assets and made significant investments across various sectors, from technology to healthcare. Black’s strategic acumen was demonstrated in notable acquisitions like the purchase of ADT and the refinancing of troubled companies.

Recent Controversies and Developments

However, Black’s career has not been without controversy. In 2021, he faced scrutiny over his ties to Jeffrey Epstein, which raised questions about due diligence in business relationships. Following a thorough review, Black stated he would step down as CEO and Chairman of Apollo in March 2021, yet he retained his role as a senior advisor. This transition has opened discussions about accountability in financial practices and the long-lasting impacts of personal associations on corporate entities.

Future Outlook

The evolution of Black’s career is indicative of the changing landscape of private equity and finance. Observers are keenly watching how the firm will adapt under new leadership while coping with the reputational aftermath of Black’s departure. As Black continues to advise Apollo, his influence will likely persist in shaping strategic directions within the firm.

Conclusion

Leon Black remains a significant figure in investment circles, with his legacy entwined in the evolution of private equity. Ongoing shifts in corporate governance and ethical standards in finance are essential themes that will influence future generations of investors. Readers should keep an eye on how these developments unfold, as they have far-reaching implications for the financial industry as a whole.