Introduction

The Lifetime Individual Savings Account (ISA) has gained significant attention since its introduction in 2017, aimed at helping individuals save for their first home or retirement. Understanding how this financial product works is crucial for anyone looking to enhance their savings strategy in the UK.

What is a Lifetime ISA?

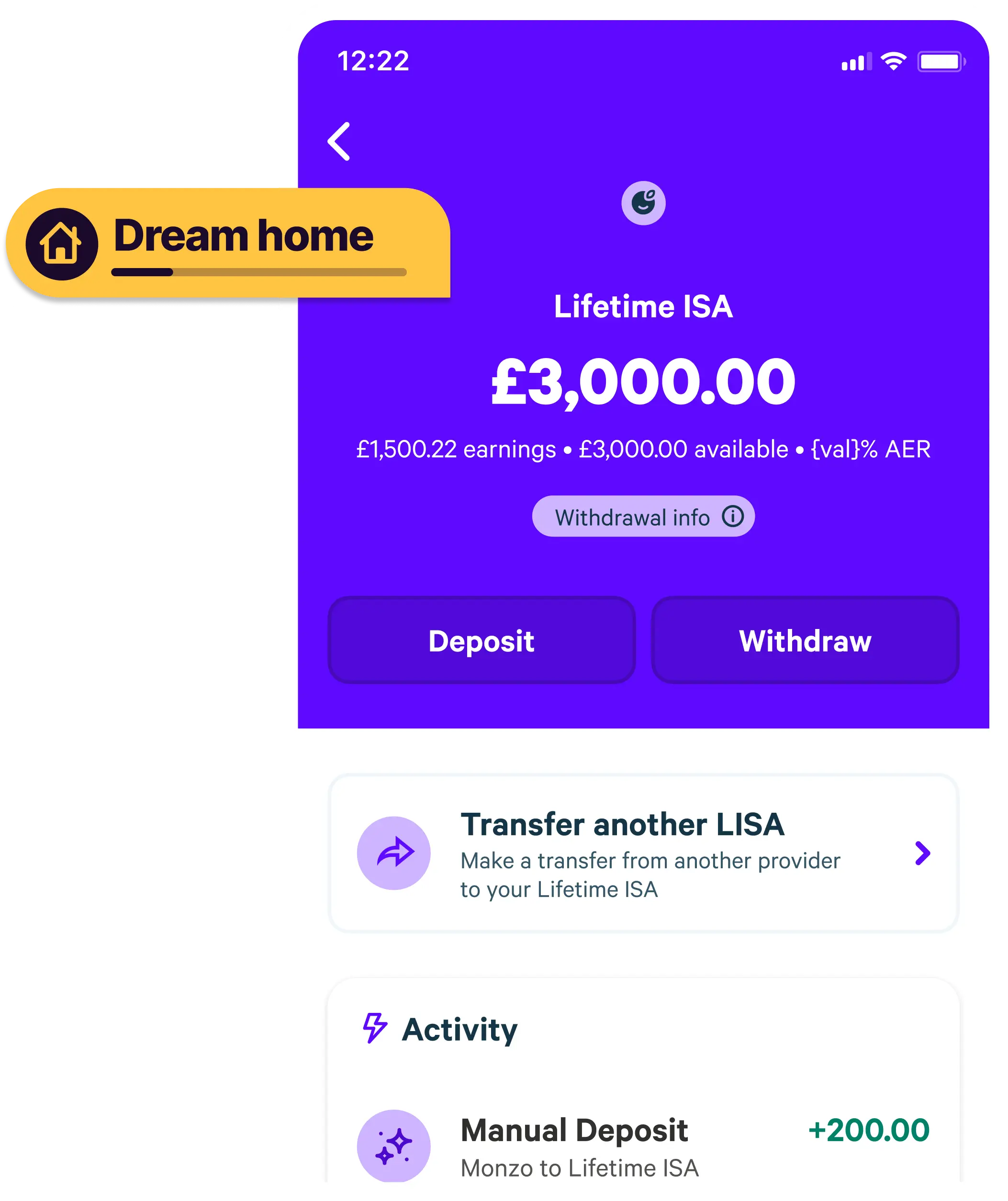

A Lifetime ISA allows individuals aged between 18 and 39 to save up to £4,000 each tax year. The government boosts savings by providing a 25% bonus on contributions, meaning for every £4 saved, the government adds an additional £1, up to a maximum of £1,000 a year. This initiative makes the Lifetime ISA an attractive option for young savers, notably benefiting those focusing on homeownership or retirement planning.

Key Features and Benefits

There are two main uses for the Lifetime ISA: purchasing a first home and saving for retirement. Funds can be withdrawn tax-free when buying a property worth up to £450,000 or after reaching the age of 60 for retirement. Additionally, if an account holder withdraws funds for reasons other than these approved purposes, a penalty of 25% on the amount withdrawn applies, which means they could get back less than they saved.

Current Trends and Popularity

Recent data suggest that more and more young adults are utilising the Lifetime ISA to aid their home-buying journey. According to HM Treasury, by the end of March 2023, over 1 million Lifetime ISAs had been opened, with millions in government bonuses claimed. This growth indicates a rising awareness of the product’s benefits, particularly amidst a challenging housing market.

Conclusion

The Lifetime ISA represents a significant step towards encouraging long-term saving and achieving homeownership among young adults in the UK. As housing prices continue to rise, effective savings tools like the Lifetime ISA become increasingly relevant. For savers, understanding the potential of this account can be a game-changer when planning for their future. As more people discover its advantages, the Lifetime ISA is likely to thrive as a cornerstone of financial planning for the younger generation.