Introduction

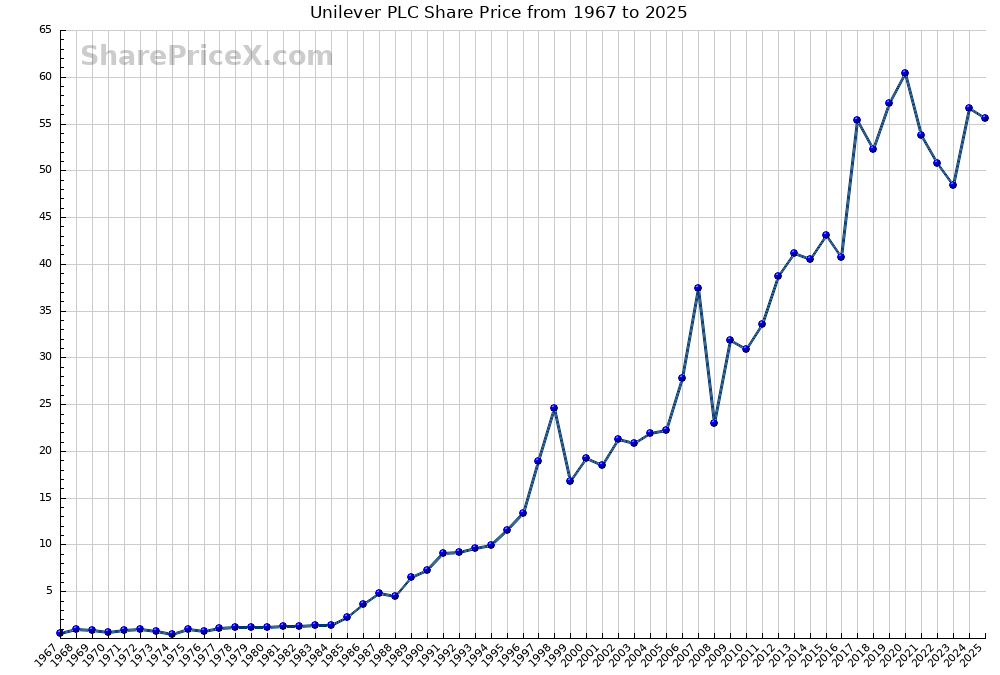

The Unilever share price is a critical indicator for investors and analysts in the stock market, reflecting the company’s overall performance, market sentiment, and economic trends. As a leading consumer goods company, changes in Unilever’s share price can influence market dynamics and investor behaviour.

Current Performance

As of October 2023, Unilever’s share price has experienced considerable fluctuations, influenced by various factors including global supply chain disruptions, changing consumer preferences, and inflationary pressures. Recent financial reports indicated that Unilever’s revenue growth has outpaced competitors, thanks in part to successful new product launches and strategic acquisitions. As of late October, Unilever shares are priced at approximately £43.50, showing a recovery from earlier declines this year.

Market Influences

Several recent developments have impacted the Unilever share price. For instance, the rising costs of raw materials and ongoing inflation have posed challenges, yet the company’s ability to pass these costs onto consumers has helped maintain its market position. Additionally, Unilever’s commitment to sustainability and ethical sourcing has resonated well with investors, further stabilising its share price amidst market uncertainties.

Future Projections

Analysts have mixed projections for Unilever’s share price in the coming months. Some believe that with the upcoming launch of several innovative health and beauty products, alongside its expansion into emerging markets, Unilever may see an upward trend in share value. Conversely, concerns such as potential recessionary impacts and increased competition could hinder price growth. The average target price from analysts is observed around £46.00, signalling a cautious optimism for investors.

Conclusion

In summary, the Unilever share price remains an important aspect for both retail and institutional investors. Factors such as product innovation, global economic conditions, and supply chain management will significantly influence its trajectory. As Unilever adapts to the evolving market landscape and focuses on sustainable practices, investors are encouraged to monitor the stock for further shifts and opportunities. Overall, staying informed about upcoming earnings reports and market news will be crucial for making informed investment decisions regarding Unilever shares.