Introduction

The BT share price is a topic of significant interest among investors and financial analysts as it reflects the company’s market performance and overall health. In recent months, various factors have influenced the fluctuations in BT Group plc’s share price, making it essential for shareholders and potential investors to stay informed about the latest developments.

Market Performance Overview

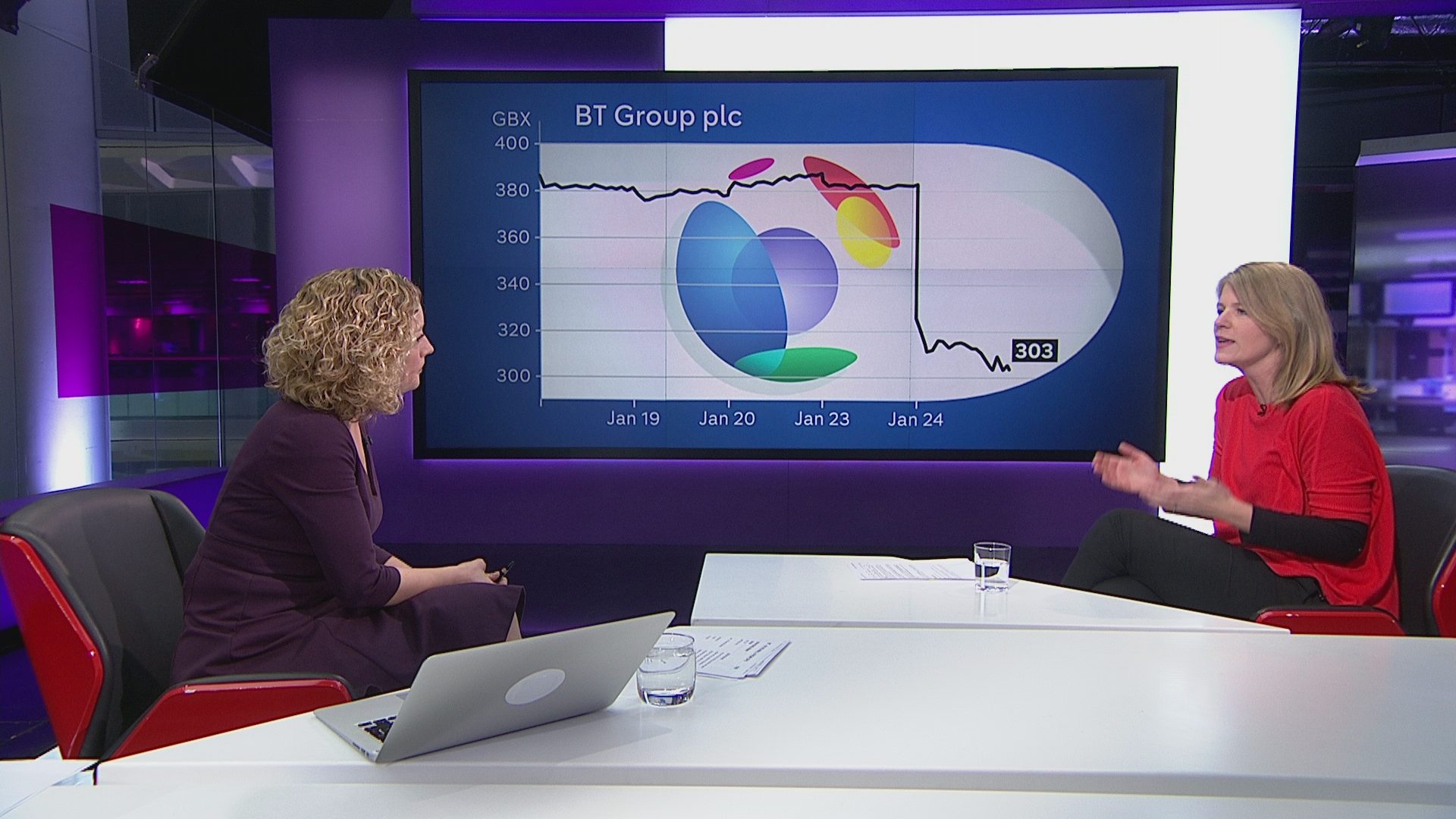

As of October 2023, BT’s share price has shown notable volatility. At the start of the month, BT shares were trading around £1.70, following a stable period earlier in the year. However, a series of announcements regarding potential cost-cutting measures and restructuring within the company have led to shifts in investor confidence.

BT Group’s latest quarterly results, released in late September 2023, revealed a drop in both revenue and profits. This downturn was attributed to increased competition in the telecommunications market and ongoing challenges in expanding broadband services. Analysts predict these factors could further impact the share price in the near term.

Recent Factors Influencing Share Price

One significant factor affecting BT’s share price has been the company’s ongoing efforts to reduce operational costs. In early October, BT announced plans to cut thousands of jobs in a bid to streamline its operations and become more competitive. While these measures are expected to enhance long-term profitability, they initially sparked some short-term concerns among investors.

Additionally, the regulatory landscape surrounding telecommunications continues to evolve. Recent changes in regulations and the potential for new competition from emerging tech companies have pressured existing providers, including BT, to adjust pricing and service offerings. The market reacted to these developments with mixed signals, leading to fluctuations in the share price.

Conclusion

The BT share price remains a focal point for many investors navigating the telecommunications sector. As BT works to address operational challenges and adapt to a rapidly changing market environment, the outlook for its share price will depend significantly on the effectiveness of its cost-cutting strategies and future growth initiatives. Analysts recommend that investors keep a close watch on both regulatory developments and BT’s quarterly performance as these will heavily influence share value moving forward. As always, potential investors should conduct thorough research and consider both risks and opportunities before making investment decisions.