Introduction

XAUUSD, representing the price of gold in US dollars, is a critical financial indicator closely monitored by investors and traders worldwide. The interplay between gold and the US dollar reflects broader economic trends, such as inflation, interest rates, and geopolitical stability, making it a vital focus for market participants.

Current Market Trends

As of October 2023, XAUUSD has witnessed notable fluctuations influenced by several factors. Recent data indicates gold prices have surged to levels not seen in over a year, driven by rising inflation rates and uncertain economic conditions. The increasing demand for gold as a hedge against inflation has pitched it higher against a backdrop of fluctuating US dollar values.

Market analysts attribute the spike in gold prices partly to the Federal Reserve’s move to maintain interest rates, which has weakened the dollar. In the last month, gold prices have increased by approximately 8%, reflecting a shift in investor sentiment towards safe-haven assets amidst economic unpredictability. Conversely, the dollar index has been trading lower as investors recalibrate their positions ahead of potential economic data releases.

Factors Influencing XAUUSD

A multitude of factors influences the XAUUSD trading pair. Among them are global politics, economic indicators, and seasonal demand patterns around the world. The ongoing conflict in various geopolitical hotspots has increased market volatility, prompting investors to seek the reliability of gold.

Technical Analysis and Predictions

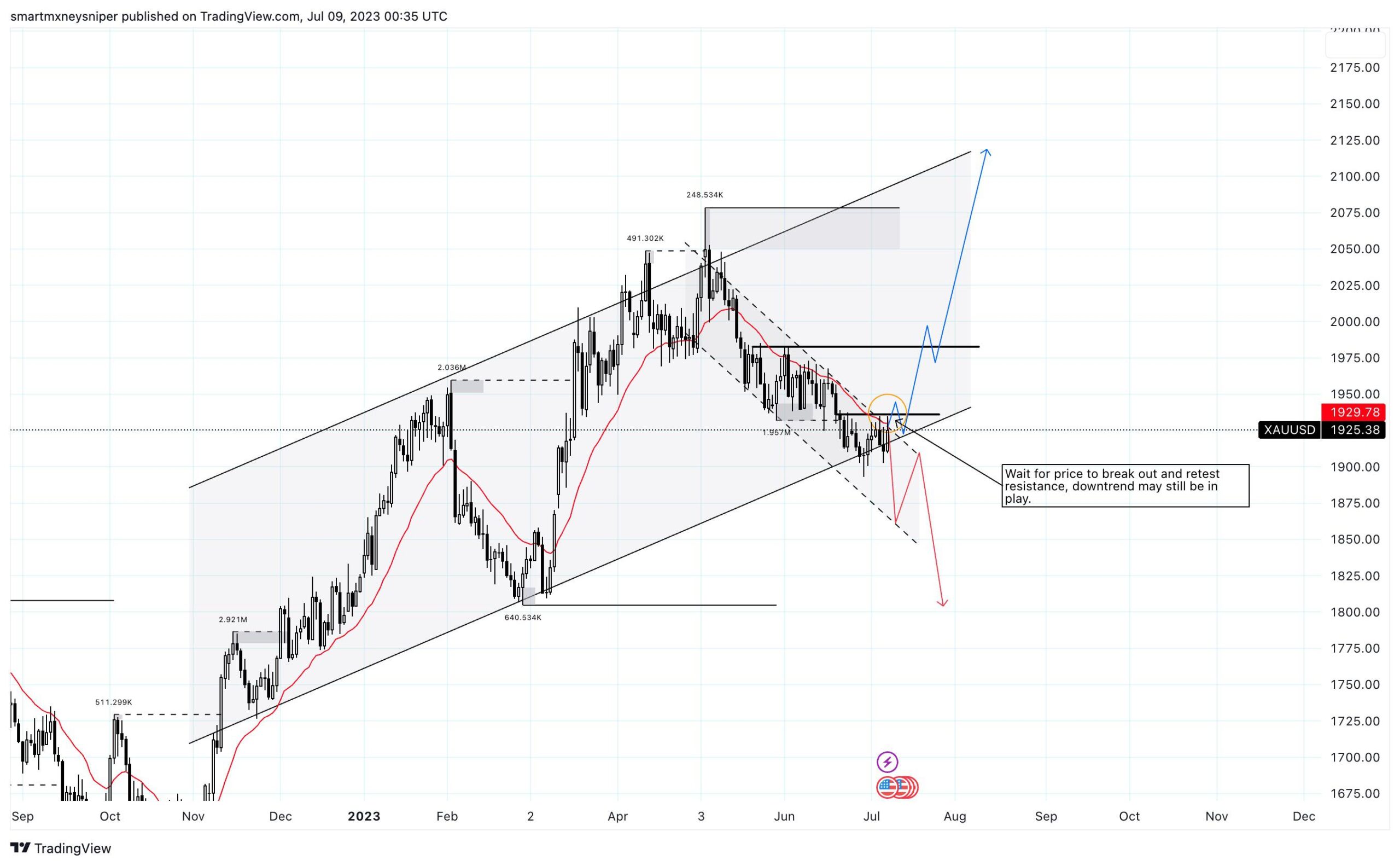

Technical analysis of XAUUSD suggests that market sentiment remains cautiously bullish in the short term, with resistance levels near $1,900 per ounce. Analysts believe a breaking point above this threshold could signal further upward momentum in gold prices. Conversely, should the prices drop below $1,800, traders may reassess their strategies, considering that such movements could lead to increased selling pressure.

Conclusion

The dynamics of XAUUSD are reflective of the bigger economic picture, making it an important metric for traders and investors alike. As the economic landscape continues to evolve with inflationary concerns and geopolitical tensions, XAUUSD remains a critical asset in investment portfolios. The trends observed in the current market suggest that gold will continue to be a valuable hedge against uncertainty, solidifying its status in the financial markets as a key indicator for investors worldwide.