The Importance of Bitcoin USD

As the largest cryptocurrency by market capitalisation, Bitcoin remains a focal point for investors and traders alike. Its exchange rate against the US Dollar (USD) is particularly significant, as it acts as a benchmark for the cryptocurrency market at large. Understanding Bitcoin USD not only helps in evaluating investment strategies but also sheds light on broader economic trends.

Current Market Trends

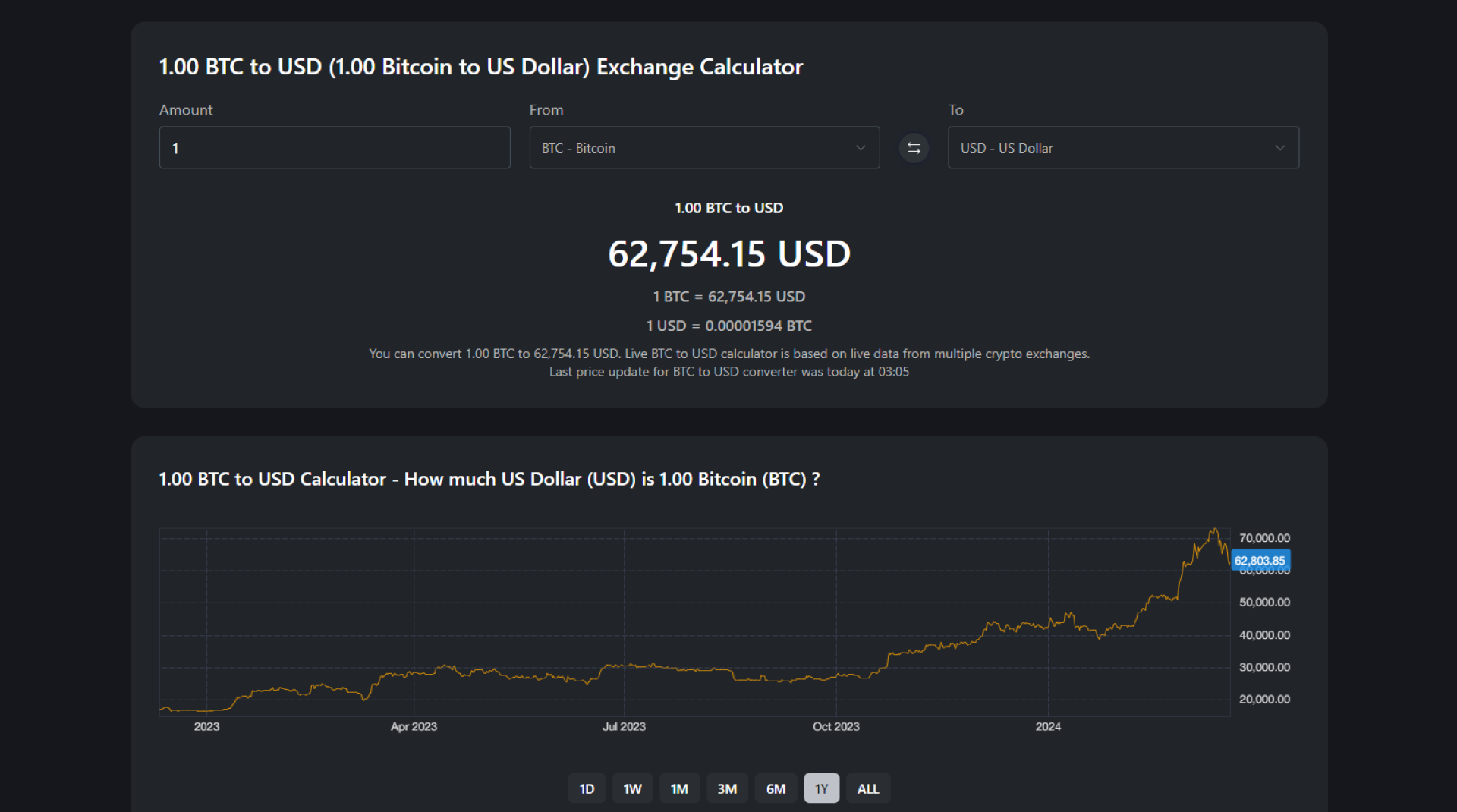

As of October 2023, Bitcoin’s value has seen substantial volatility. Following a resurgence in demand driven by institutional interest and increased regulatory clarity in various regions, Bitcoin briefly reached a high of approximately $45,000 USD. However, the asset faced corrections, retreating to levels around $40,000 USD amid broader market pullbacks. Analysts suggest that these fluctuations are largely influenced by macroeconomic factors, including inflation rates, changes in interest policies by central banks, and ongoing global uncertainties.

Factors Influencing Bitcoin USD

One of the primary drivers of Bitcoin’s price is its limited supply; there will only ever be 21 million Bitcoins mined. This scarcity, combined with increasing demand, often fuels bullish sentiment among investors. Additionally, the introduction of spot Bitcoin ETFs in the United States has played a crucial role in attracting more institutional investors, further stabilising the price action. On the other hand, geopolitical tensions, regulatory news, and shifts in investor sentiment often lead to rapid price changes.

Future Outlook for Bitcoin USD

Looking ahead, many analysts predict that Bitcoin USD will continue to experience volatility. Historical patterns suggest that Bitcoin tends to follow boom and bust cycles, raising questions about its long-term viability as a stable currency. Market experts recommend that potential investors keep a close eye on regulatory developments, technological advancements, and macroeconomic trends that could drive price movements.

Conclusion

The relationship between Bitcoin and the US Dollar remains a critical focus for investors and market observers. As Bitcoin continues to evolve as an asset class, understanding its valuation against the USD will be fundamental in navigating the future of cryptocurrency investing. Despite uncertainties, many enthusiasts maintain a bullish perspective, positing potential new all-time highs motivated by increasing adoption and market maturity.