Introduction

In recent months, Santander Bank has announced the closure of several bank branches across the UK, raising concerns among customers and communities relying on these local services. As banking increasingly shifts towards digital platforms, the implications of these closures on accessibility and customer support have sparked significant debate.

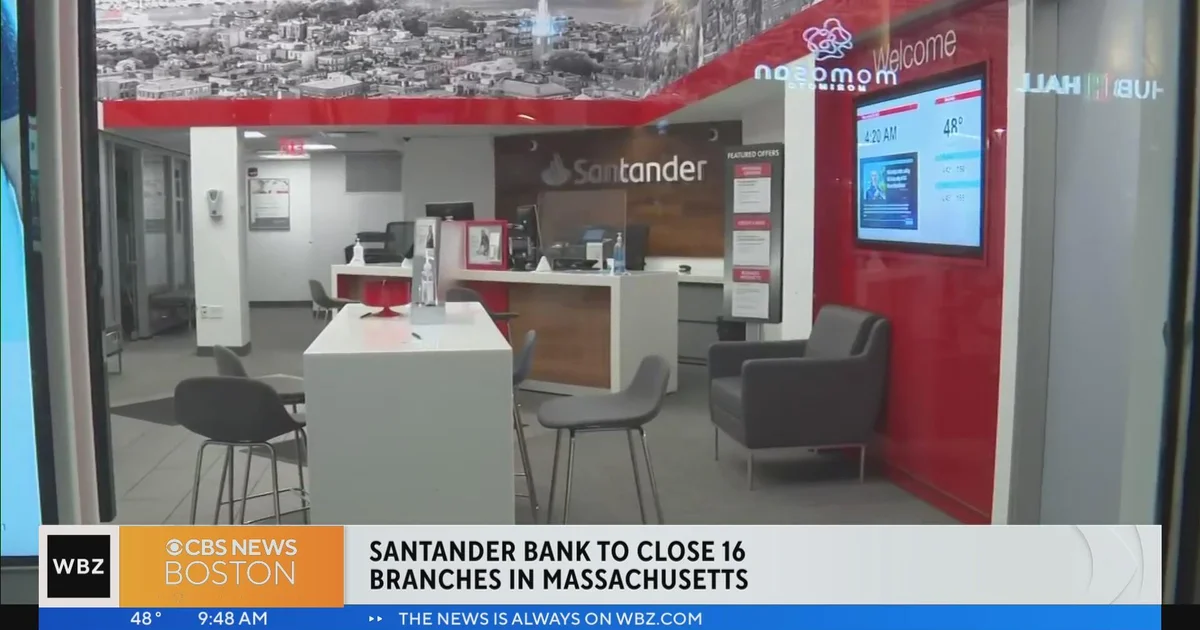

Details of the Closures

In late September 2023, Santander confirmed that it will be closing over 100 branches by the end of the year. This decision comes as part of a broader trend within the banking sector, where many financial institutions are reassessing their physical presence in favour of online banking solutions. Santander’s closures are particularly concentrated in urban areas, where foot traffic has decreased due to changing consumer habits.

Reasons Behind the Decision

According to Santander, the decision to close branches is primarily driven by a decline in in-person banking transactions, as more customers opt for digital banking services. A spokesperson for the bank stated that approximately 87% of customers now use online banking, with mobile transactions soaring. As a result, maintaining a large number of physical branches has become less viable financially.

Impact on Customers and Communities

The closures will undoubtedly have a profound effect on customers who rely on face-to-face banking services, particularly the elderly or those without easy access to technology. Many customers have expressed frustration, stating that online and mobile banking cannot replace the personal service and assistance provided by branch staff. Community leaders have also raised concerns about the economic implications of losing local banking facilities, which often serve as important hubs for community engagement and support.

Conclusion

As Santander proceeds with these branch closures, the bank has committed to enhancing it’s online services and support, aiming to make the transition easier for affected customers. However, it remains crucial for Santander to find a balance between modernising its services and addressing the needs of all customers. Looking forward, the trend of bank branch closures may continue, prompting a need for banks to innovate solutions that maintain accessibility for all sectors of the population, ensuring that no one is left behind in the digital banking revolution.