Introduction

The share price of Relx PLC, a global provider of information-based analytics and decision tools, has become a focal point for investors and analysts alike. With the ongoing shifts in the market and the company’s robust performance metrics, understanding the current trends and factors influencing the Relx share price is crucial for both current and prospective shareholders.

Current Share Price and Market Performance

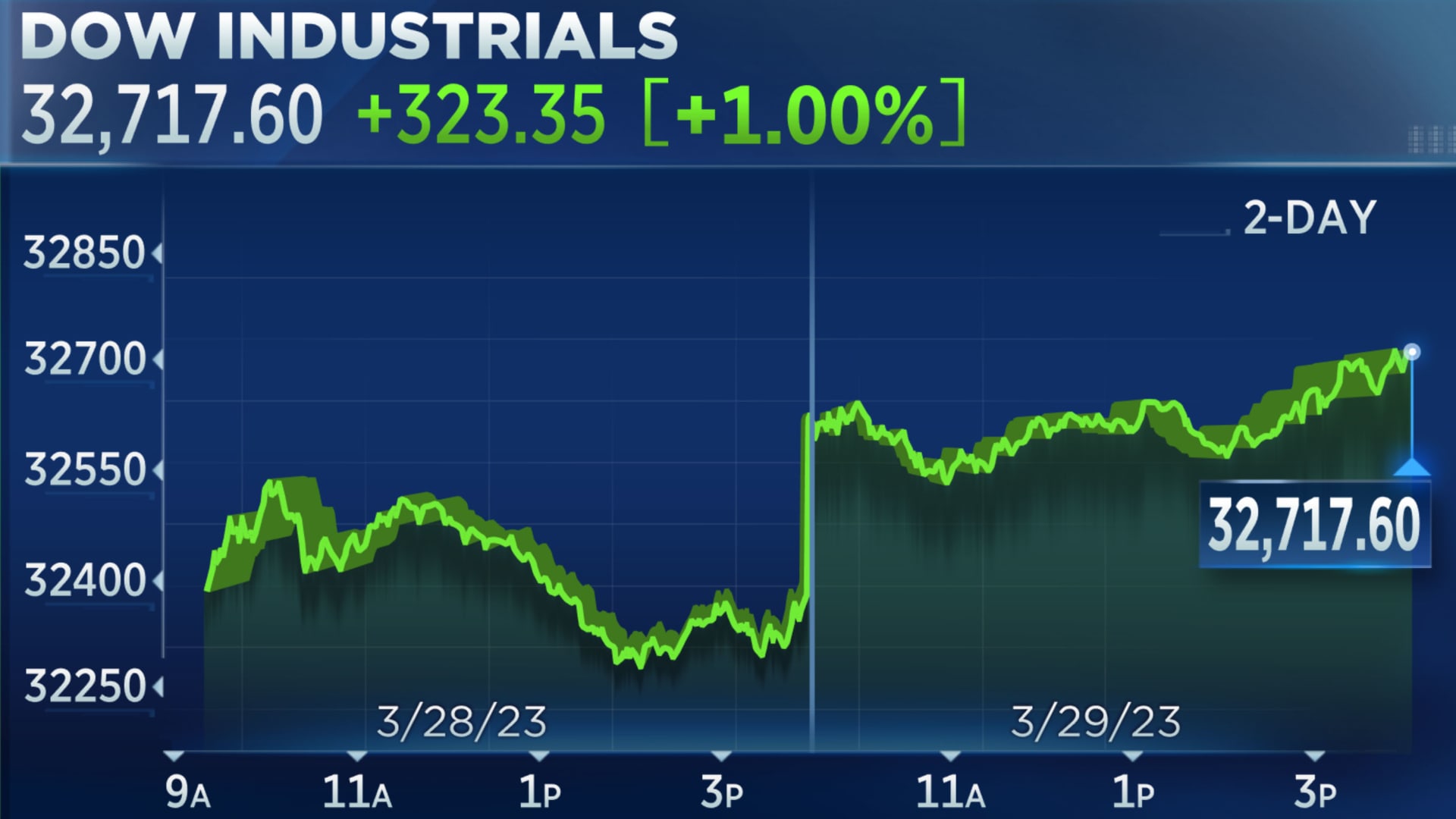

As of early October 2023, the Relx share price has seen a notable increase, reflecting strong demand for its products and services amid an evolving digital landscape. The shares were trading at approximately £24.50, up from £23.15 in the previous quarter, representing a 5.8% growth. Analysts attribute this growth to increased revenue from the analytical and subscription services that have become increasingly vital during the pandemic recovery phase.

Factors Influencing the Share Price

Several factors are influencing the Relx share price currently. Firstly, the company’s strategic focus on digitisation and analytics solutions has attracted new customers across various sectors, contributing to rising revenues. Furthermore, Relx’s commitment to sustainable practices and responsible data management is enhancing its brand reputation, positively impacting investor confidence. Second, market conditions such as interest rates, inflation, and broader economic indicators are also relevant, with Relx navigating these challenges effectively compared to its competitors.

Analyst Opinions and Forecasts

Financial analysts remain optimistic about the future of Relx, with many maintaining a ‘buy’ rating on the stock. Analysts from major financial institutions have projected that the share price could reach upwards of £27 by the end of 2024, assuming continued growth in digital subscription services and successful integration of recent acquisitions. However, they also caution investors to be aware of potential volatility related to market fluctuations and geopolitical tensions.

Conclusion

In conclusion, the Relx share price is currently on an upward trajectory, reflecting the company’s strong fundamentals and market positioning. Investors should keep a close eye on the company’s ongoing performance metrics, geopolitical developments, and changes in market conditions that could affect future share valuations. With the predicted growth and positive analyst sentiment, Relx remains an attractive consideration for investors looking to diversify their portfolios in the information services sector.