Introduction

As financial markets around the world continue to react to shifts in economic indicators and geopolitical events, keeping abreast of stock market news today is essential for investors and analysts alike. Understanding current market conditions helps stakeholders make informed decisions, minimizing risks and seizing opportunities in this volatile environment. Recent developments have set the tone for trading activities, making it critical to examine the latest trends and indicators affecting the stock market.

Recent Market Highlights

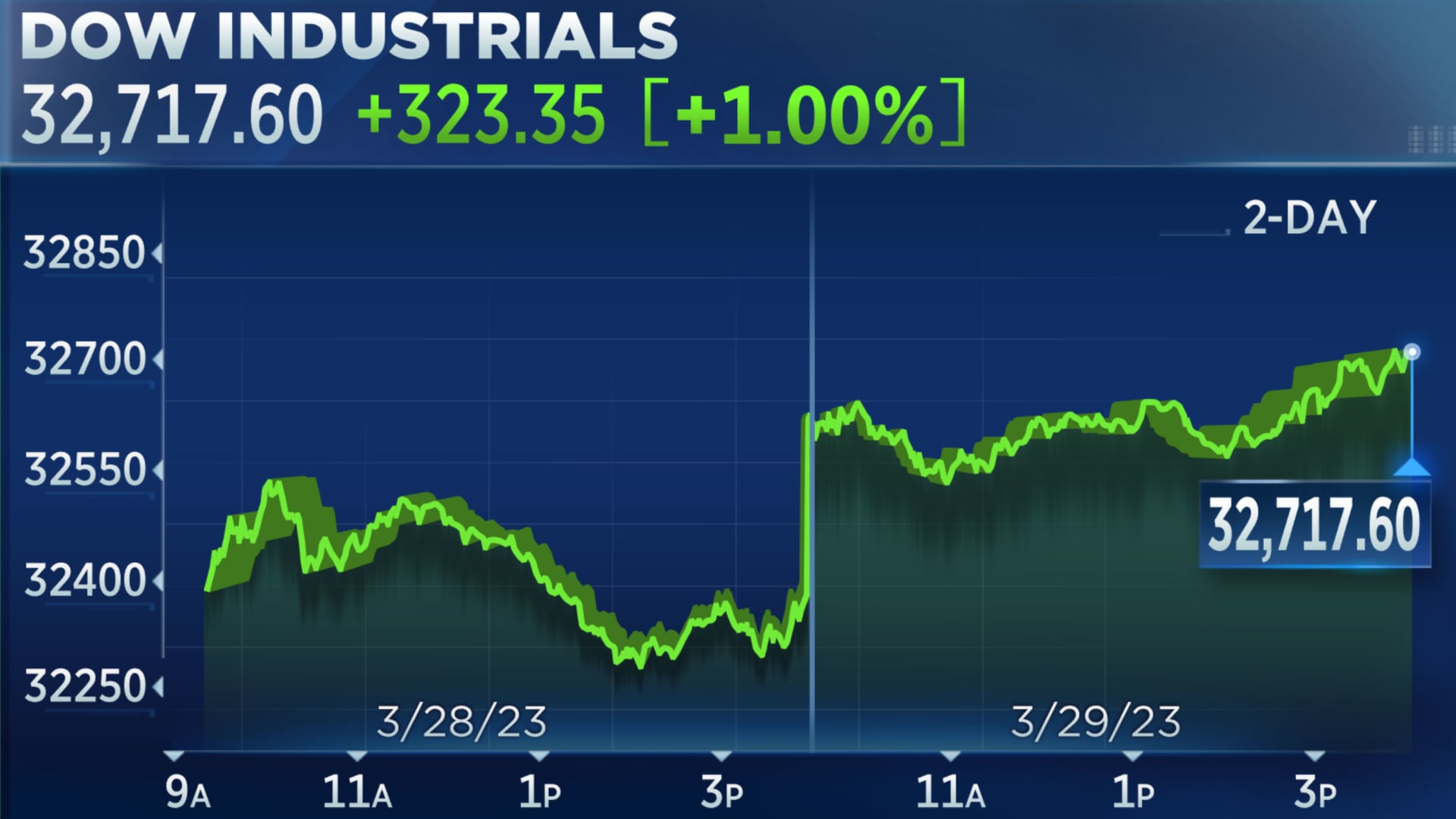

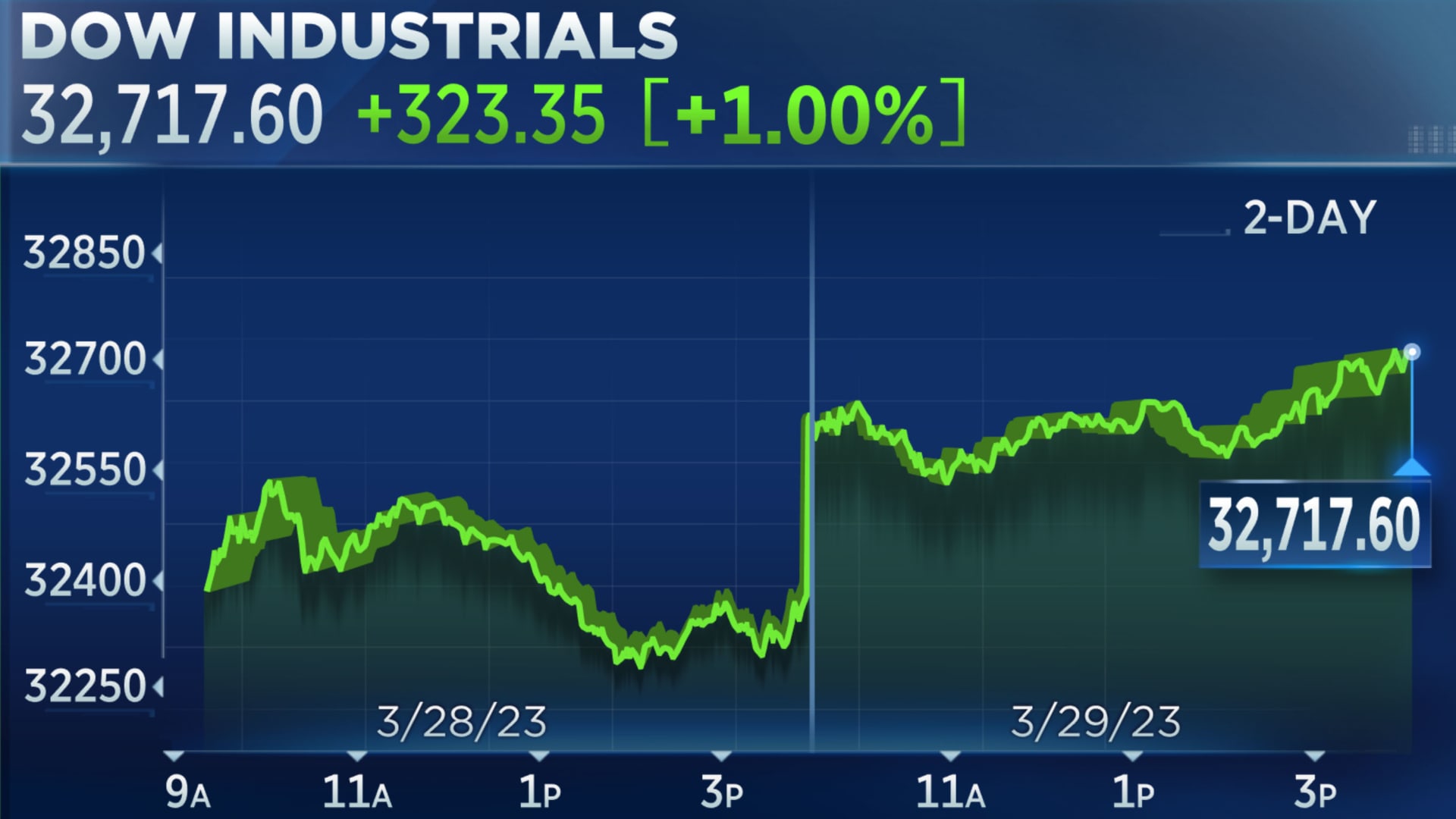

Today, stocks opened positively as investors grew optimistic about upcoming corporate earnings reports. The S&P 500 index has gained 1.2%, driven by strong performances from technology and healthcare sectors. This uptick follows a week of mixed economic data, including lower-than-expected inflation rates which led to speculation regarding potential interest rate cuts by the Federal Reserve.

In specific company news, tech giant Tesla has seen its shares rise by 3% following a successful quarterly earnings report that surpassed analysts’ expectations. Strong vehicle deliveries and the company’s advancements in battery technology have catalysed this positive movement. Meanwhile, shares of major airlines are facing a decline amid rising fuel prices, presenting a mixed bag for investors tracking these stocks.

Global Market Influences

Globally, markets are influenced by the ongoing conflict in Eastern Europe, with resource supply chains still disrupted. The energy sector remains volatile, with oil prices fluctuating due to concerns over production levels amid geopolitical tensions. Asian markets mirrored the European market’s cautious optimism, with Japan’s Nikkei index rising following signs of economic recovery and increased consumer spending. However, concerns persist regarding China’s economic performance, especially in the manufacturing sector, which is affecting investor sentiment worldwide.

Conclusion

As we look into the stock market news today, it is clear that economic indicators, corporate earnings, and global events are crucial drivers of market performance. Investors are advised to remain vigilant as they navigate this ever-changing landscape. Analysts predict that upcoming earnings in the technology sector will continue to shape market trends, while attention to geopolitical developments remains paramount. By staying informed of these factors, investors can better position themselves for potential shifts in market sentiment and take proactive steps in their investment strategies.