The Rise of Cryptocurrency Trading

In recent years, cryptocurrency trading has surged in popularity, becoming a significant part of the global financial ecosystem. With the advent of digital currencies like Bitcoin, Ethereum, and countless altcoins, millions of investors and traders are stepping into the crypto markets. Understanding cryptocurrency trading is crucial not only for potential investors but also for understanding future financial trends.

Current Trends in Cryptocurrency Trading

As of 2023, the cryptocurrency trading market has shown resilience and adaptation in response to economic changes. DeFi (Decentralized Finance), NFTs (Non-Fungible Tokens), and Automated Trading Bots are at the forefront of innovation, attracting both seasoned and novice traders. The total market capitalization of cryptocurrencies has crossed the $1 trillion mark, reflecting growing mainstream acceptance and institutional investment.

Moreover, numerous countries are beginning to recognise and regulate cryptocurrencies, providing more security for investors, while also boosting trading activity. For instance, the UK’s Financial Conduct Authority (FCA) has implemented guidelines to protect consumers and ensure market integrity, validating cryptocurrency trading as a legitimate investment avenue.

Risks and Rewards

While cryptocurrency trading presents lucrative opportunities, it is essential to acknowledge the risks involved. Volatility remains a significant challenge, as prices can fluctuate dramatically within short periods, leading to potential losses. Additionally, regulatory risks are prevalent, as ongoing global regulatory scrutiny could alter the future landscape of cryptocurrency trading.

However, astute investors have also seen substantial returns. Many early adopters of Bitcoin and altcoins have reported life-changing gains. As more people venture into cryptocurrency trading, it has diversified investment portfolios, offering alternatives beyond traditional stocks and bonds.

The Future of Cryptocurrency Trading

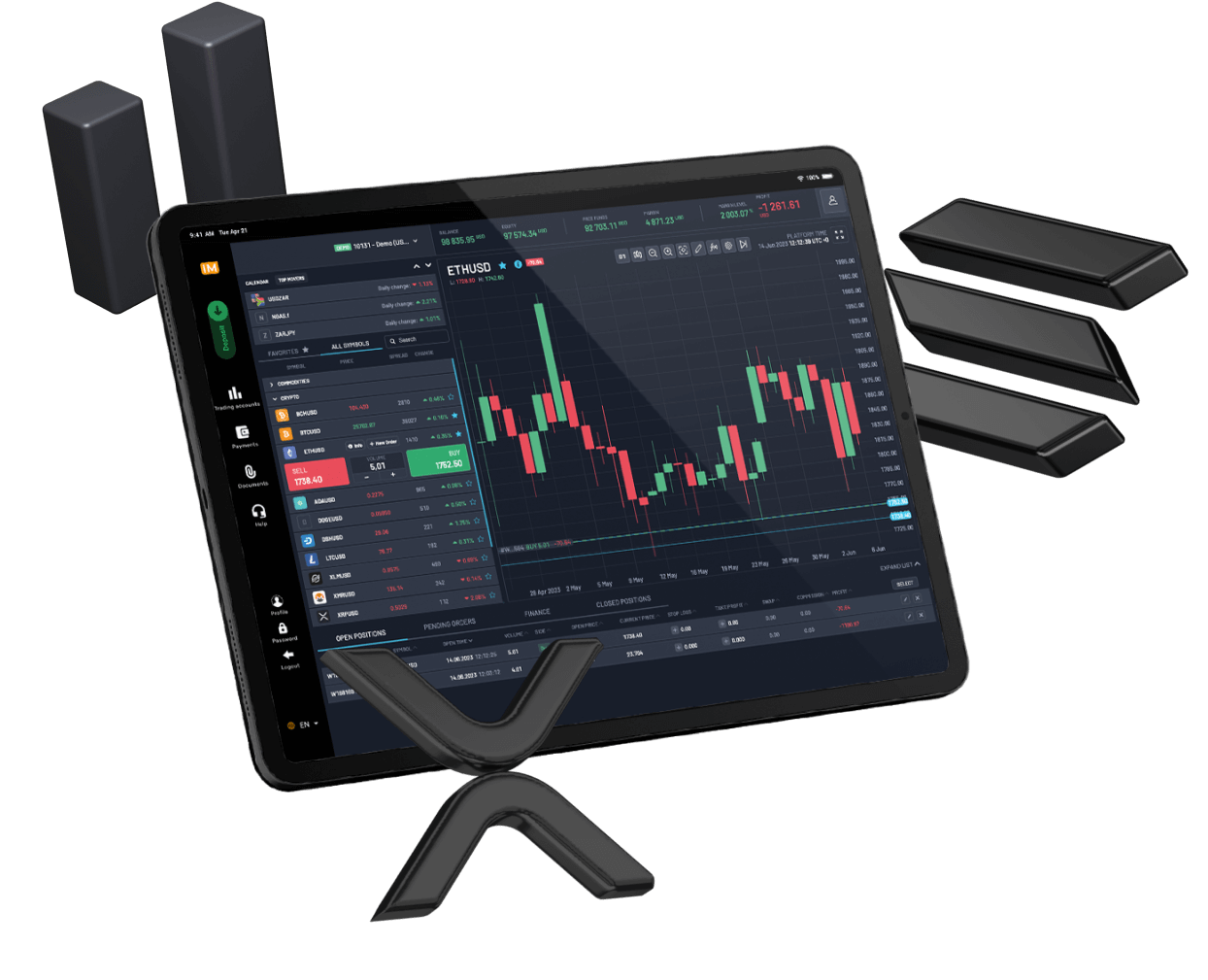

Looking ahead, the future of cryptocurrency trading appears promising. Increased technological advancements, such as the integration of Artificial Intelligence in trading strategies and the exploration of blockchain technology’s potential in various sectors, are set to enhance trading experiences and opportunities. Moreover, as societal and market acceptance of cryptocurrencies rises, it is expected that trading will become more accessible and user-friendly.

Conclusion

In conclusion, cryptocurrency trading stands as a pivotal component of modern investment strategies. While it carries inherent risks, the potential for high rewards and the rapid evolution of financial technology present exciting prospects for both individuals and institutions. As we navigate 2023 and beyond, staying informed about market trends and regulatory changes will be crucial for any trader looking to dive into the world of cryptocurrencies.