Introduction to Cryptocurrency Trading

Cryptocurrency trading has emerged as a significant aspect of the global financial market, reflecting the rapid growth and adoption of digital currencies. As more individuals and institutions invest in cryptocurrencies like Bitcoin and Ethereum, understanding the dynamics of trading these digital assets becomes essential. This article explores the current trends, challenges, and future prospects of cryptocurrency trading.

Current Trends in Cryptocurrency Trading

As of late 2023, the cryptocurrency market has experienced notable volatility, with Bitcoin recently surpassing the $50,000 mark again after fluctuating for several months. Influences such as regulatory changes, adoption rates, and macroeconomic factors play critical roles in this market. The rise of decentralized finance (DeFi) platforms and non-fungible tokens (NFTs) has also introduced new trading opportunities, attracting a diverse pool of investors.

The increase in institutional investment has further legitimised the space, as companies like Tesla and MicroStrategy continue to add Bitcoin to their balance sheets. This influx of capital has driven conversations surrounding the future value of cryptocurrencies and their potential to revolutionise traditional finance.

Challenges in Cryptocurrency Trading

Despite its growth, cryptocurrency trading is not without challenges. Regulatory scrutiny remains a significant concern, as governments around the world aim to establish frameworks to ensure consumer protection and combat fraud. These regulations can impact market stability and investor sentiment, resulting in sudden price swings.

Moreover, the market’s inherent volatility can be intimidating for newcomers. The risk of significant losses looms large for traders, particularly those who engage in margin trading or speculative strategies without thorough research. As a result, it is crucial for traders to develop a sound risk management strategy and stay informed about market developments.

Future of Cryptocurrency Trading

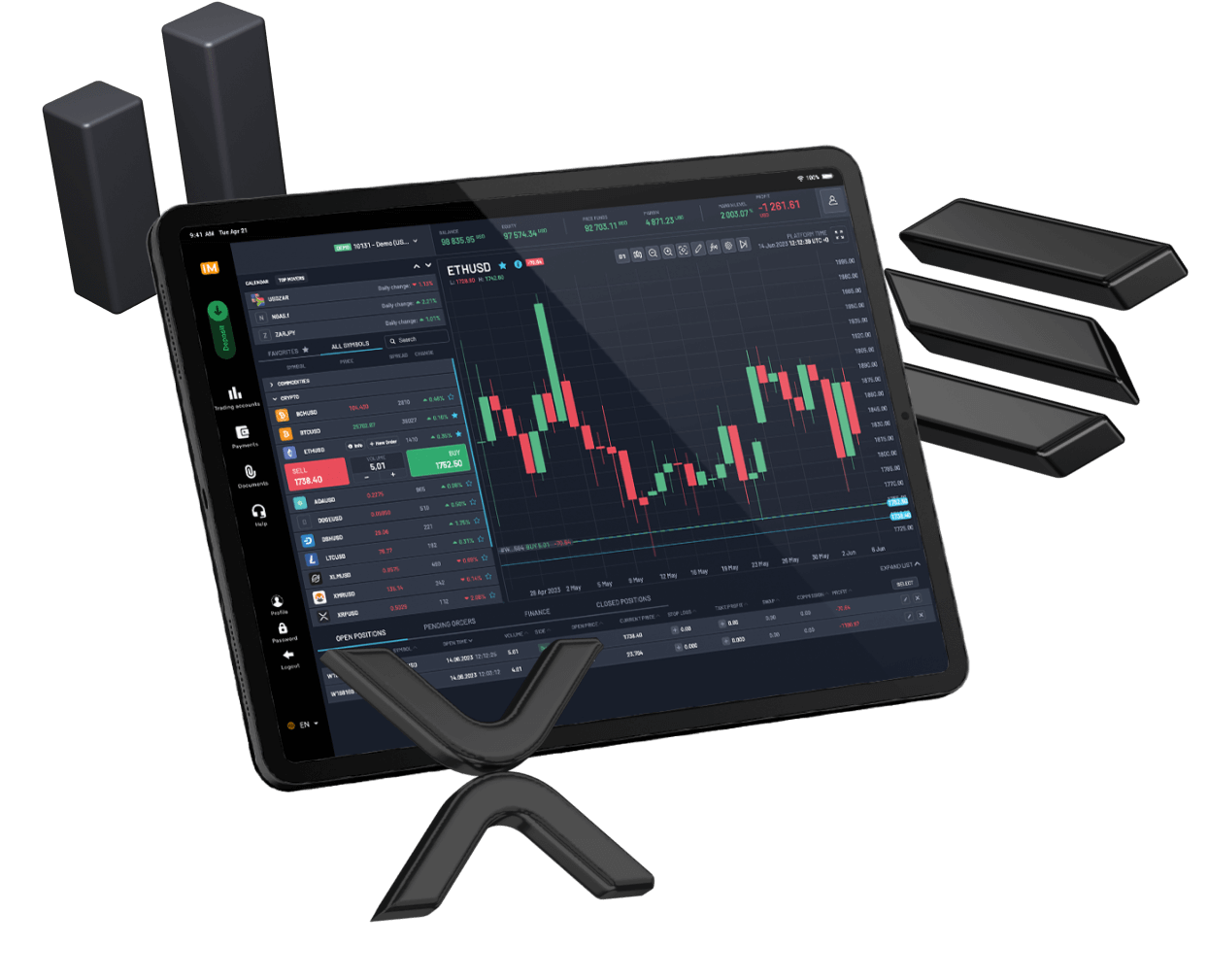

Looking ahead, the cryptocurrency trading landscape is poised for evolution. Advancements in blockchain technology may lead to improved trading platforms that enhance security and user experience. Additionally, as more financial instruments linked to cryptocurrencies emerge, such as ETFs and futures, the integration of cryptocurrencies into mainstream finance is likely to accelerate.

Conclusion

Cryptocurrency trading is no longer a niche market but a significant player in the global economy. As trends evolve and new challenges arise, it is essential for traders to remain informed and adaptable. For investors, understanding the forces at play in this dynamic environment will be key to navigating the complexities and capturing the opportunities that cryptocurrency trading presents. The significance of this market will only grow, making it a focal point for both current and future investors.