Introduction

Cryptocurrency trading has gained significant prominence in recent years, evolving from a niche market into a mainstream financial activity. With the rise of Bitcoin, Ethereum, and other digital currencies, investors and traders are increasingly drawn to the potential for high returns. Moreover, the rapid development of blockchain technology and the increasing number of financial institutions entering the space highlight the relevance of cryptocurrency trading in today’s economy.

The Current Landscape of Cryptocurrency Trading

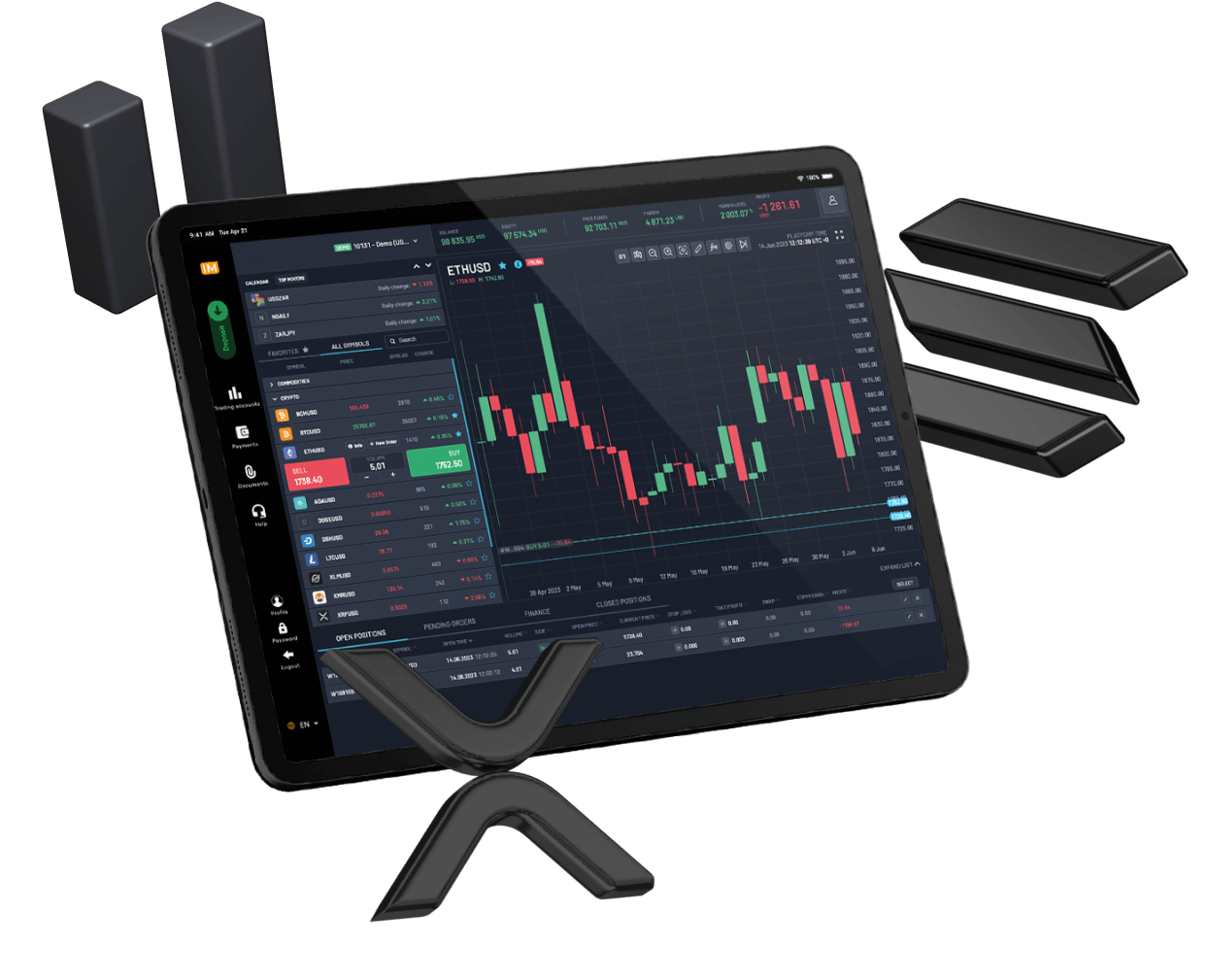

As of late 2023, the total market capitalization of cryptocurrencies hovers around $1 trillion, demonstrating moderate recovery following past market volatility. Major exchanges like Binance, Coinbase, and Kraken have refined their trading platforms, offering advanced tools and features, including margin trading, futures contracts, and staking opportunities. Furthermore, regulatory frameworks worldwide are becoming more defined, providing clearer guidelines for traders while aiming to protect consumers.

Recent trends indicate that institutional investors are becoming more involved in cryptocurrency trading. For example, companies such as Tesla and MicroStrategy are incorporating Bitcoin into their treasury reserves, exemplifying a growing acceptance of digital currencies as legitimate assets. Additionally, the rise of decentralized finance (DeFi) platforms has transformed how individuals can trade and lend cryptocurrencies, often without the need for traditional banking intermediaries.

Challenges in Cryptocurrency Trading

Despite the opportunities, cryptocurrency trading is not without its challenges. The market is notoriously volatile, with prices subject to dramatic fluctuations based on news events, regulatory changes, and market sentiment. In 2022, major cryptocurrencies experienced significant downturns, prompting discussions about the sustainability of certain projects and the broader market. Security issues, including hacking incidents and thefts from exchanges, remain a major concern for traders, necessitating robust security measures and due diligence.

Conclusion and Future Outlook

As cryptocurrency trading continues to mature, it is likely to become an integral part of investors’ portfolios, blending with traditional asset classes. Analysts predict that as technology advances and adoption increases, regulatory clarity will further enhance the market’s attractiveness. For those considering entering cryptocurrency trading, it’s crucial to remain informed about market trends, employ sound risk management strategies, and understand the underlying technologies that drive this innovative space.