Introduction to Cryptocurrency Trading

Cryptocurrency trading has become a pivotal aspect of modern finance, attracting both seasoned investors and newcomers alike. The rise of digital currencies like Bitcoin and Ethereum has ushered in a new era of trading, characterized by volatility, innovative technologies, and regulatory challenges. As the sector continues to evolve, understanding the latest trends is essential for anyone looking to engage in cryptocurrency trading.

Recent Developments in Cryptocurrency Trading

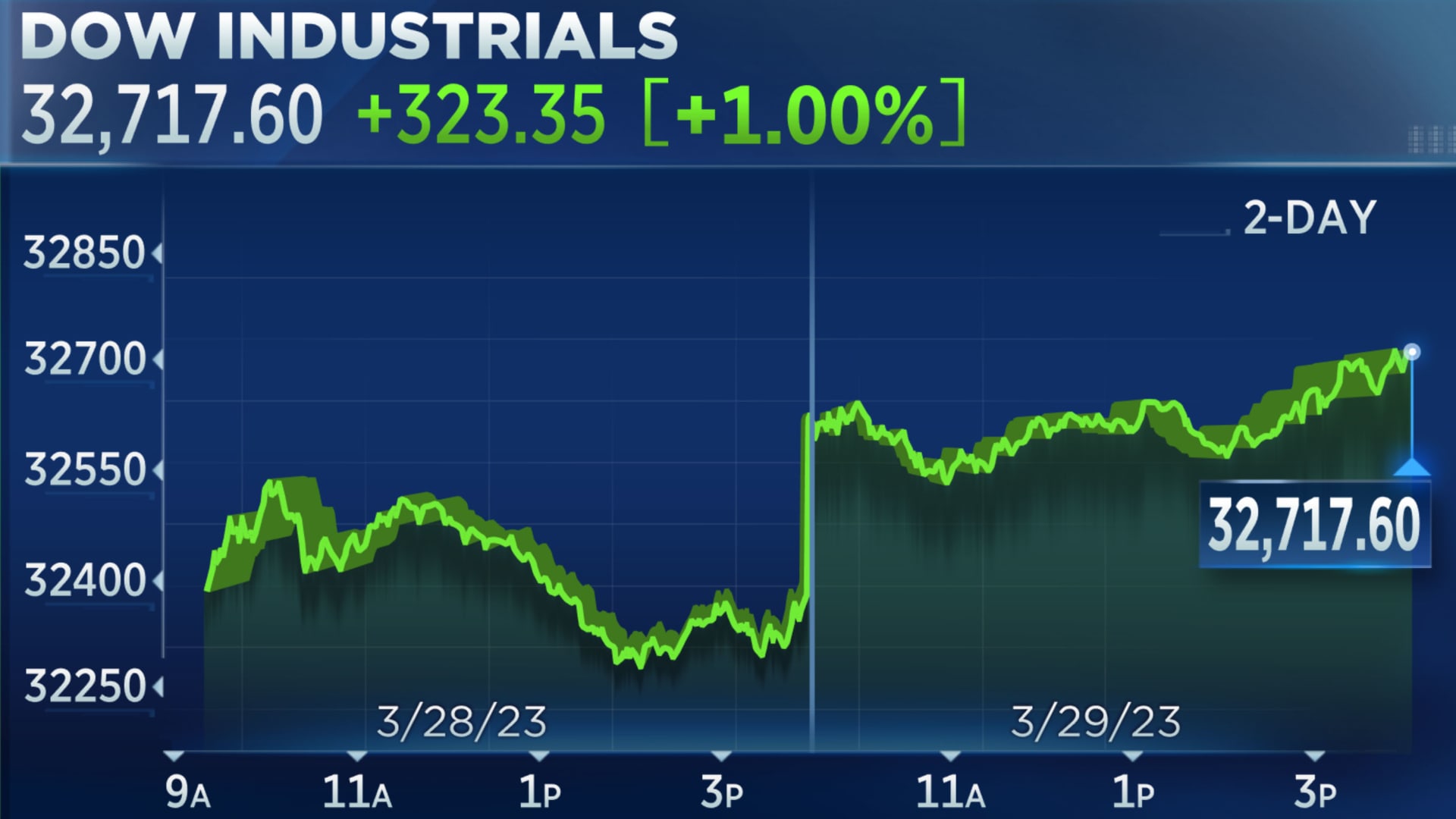

In 2023, the cryptocurrency market has experienced significant fluctuations, spurred by global economic conditions and technological advancements. Notably, the introduction of Central Bank Digital Currencies (CBDCs) has been a focal point in discussions about the future of money. Countries such as China and the European Union are piloting their CBDCs, which may influence how private cryptocurrencies are perceived and traded.

Moreover, regulatory scrutiny has intensified as governments seek to establish frameworks that protect investors. The United Kingdom’s Financial Conduct Authority (FCA) has been actively engaging with cryptocurrency exchanges, aiming for compliance to mitigate risks of fraud and ensure market integrity. Traders must stay abreast of these regulations, as they could profoundly affect market dynamics.

The Role of Technology in Trading

Technological innovation remains at the forefront of the cryptocurrency trading landscape. Decentralised finance (DeFi) platforms are gaining traction, allowing users to trade cryptocurrencies without intermediaries, thereby enhancing accessibility. Additionally, the use of artificial intelligence and machine learning in trading strategies is on the rise, empowering traders to make data-driven decisions more effectively.

Popular trading platforms are also expanding their offerings to include options for margin trading, futures, and other derivatives, providing traders with more choices to maximise their profits. However, these opportunities come with increased risks, requiring a comprehensive understanding of market mechanics.

Conclusion and Future Outlook

As 2023 progresses, cryptocurrency trading continues to attract significant attention, both for its potential rewards and inherent risks. The emergence of CBDCs, increasing regulation, and rapid technological developments are reshaping the trading landscape. For traders, staying informed about these shifts is paramount, as they may influence trading strategies and long-term investment decisions.

Looking ahead, the market is likely to witness further maturation, with a push towards greater transparency and security. Adapting to these changes will not only be crucial for risk management but also for capitalising on the opportunities that cryptocurrency trading presents.