Introduction

The share price of NatWest Group plc has garnered significant attention from investors and market analysts alike. As one of the leading financial institutions in the UK, NatWest’s performance on the stock market is a barometer of economic sentiment. Understanding the factors influencing NatWest’s share price is crucial for investment decisions.

Recent Performance Trends

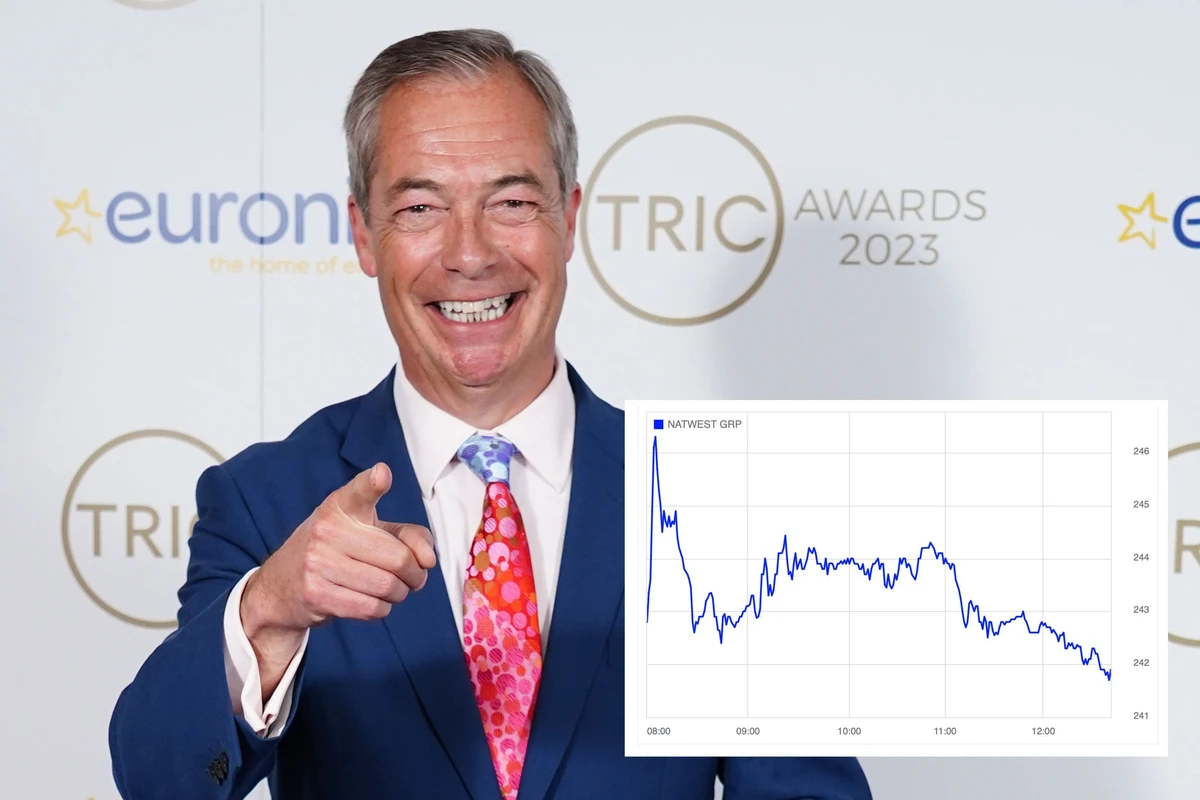

As of October 2023, NatWest’s share price has experienced fluctuations reflecting broader market trends, economic conditions, and the bank’s financial results. The share opened at around £2.75 per share earlier this month and reached a high of £2.93, marking a 6.5% increase. This surge is largely attributed to the bank’s robust quarterly earnings report, which indicated a rise in net profit and a decline in loan defaults.

According to the latest report from NatWest Group, they posted a pre-tax profit of £1.8 billion in Q3 2023, up from £1.5 billion in the previous quarter. Analysts attribute this performance to rising interest rates, which have bolstered banks’ margins. However, global economic concerns, including inflation and geopolitical tensions, continue to introduce volatility in the stock market.

Market Influences

The rise in NatWest’s share price can also be linked to positive investor sentiment towards the UK banking sector, especially as the Bank of England signals a potential shift in monetary policy aimed at controlling inflation. Additionally, the bank’s digitalisation efforts have started to pay off, enhancing customer engagement and reducing operational costs, further driving investor confidence.

On the flip side, market analysts warn of potential headwinds. Economic uncertainties, including potential recessions and the cost-of-living crisis facing many consumers, could affect loan demand and impact future profits.

Conclusion

In summary, while NatWest’s recent share price movements are encouraging, investors should remain vigilant about the broader economic landscape that influences market dynamics. Keeping an eye on quarterly earnings reports, interest rate policies, and global economic trends will be key in forecasting future changes in NatWest’s share price and overall financial health.

As investors navigate these waters, the significance of staying informed and prepared for variable market conditions cannot be overstated.